USDJPY Reversing on Fed/BOJ Divergence

JPY Rallying

USDJPY has come under fresh selling pressure today on the back of a meeting yesterday between US Treasury Secretary Bessent and Japan Fin Min Katayama. Bessent reportedly focused on the need for sound monetary policy from the BOJ, citing the very different conditions between now and 12 years ago when Abenomics was first introduced.

New Japanese PM

These comments come as markets have been eyeing the risk of a more dovish stance from the BOJ, in line with the fiscally expansion many think will be seen under new Japanese PM Takaichi. Bessent’s hawkish pressure on the BOJ won’t necessarily influence the bank but traders have responded today by bidding up the Yen all the same. Indeed, despite safe-havens generally seen on the backfoot this week amidst rising US/China trade deal optimism, USDJPY continue to move lower on Tuesday, reversing from recent highs.

No Change From BOJ

The BOJ is not expected to make any policy adjustments when it meets later this week. However, with the Fed widely expected to cut rates again when it meets on Friday, USDJPY looks poised for further losses this week. This is particularly likely if we hear more decidedly dovish tone from the Fed tomorrow and any hawkish signals from the BOJ on Friday, creating deeper divergence between the two central banks.

Technical Views

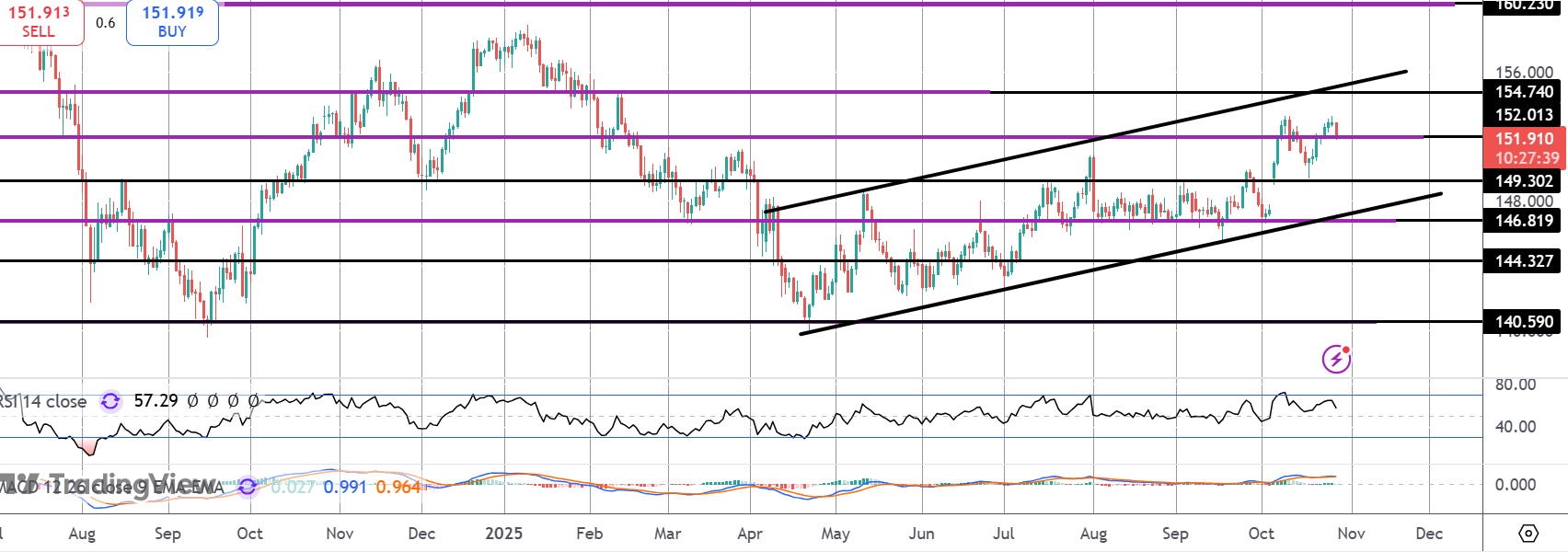

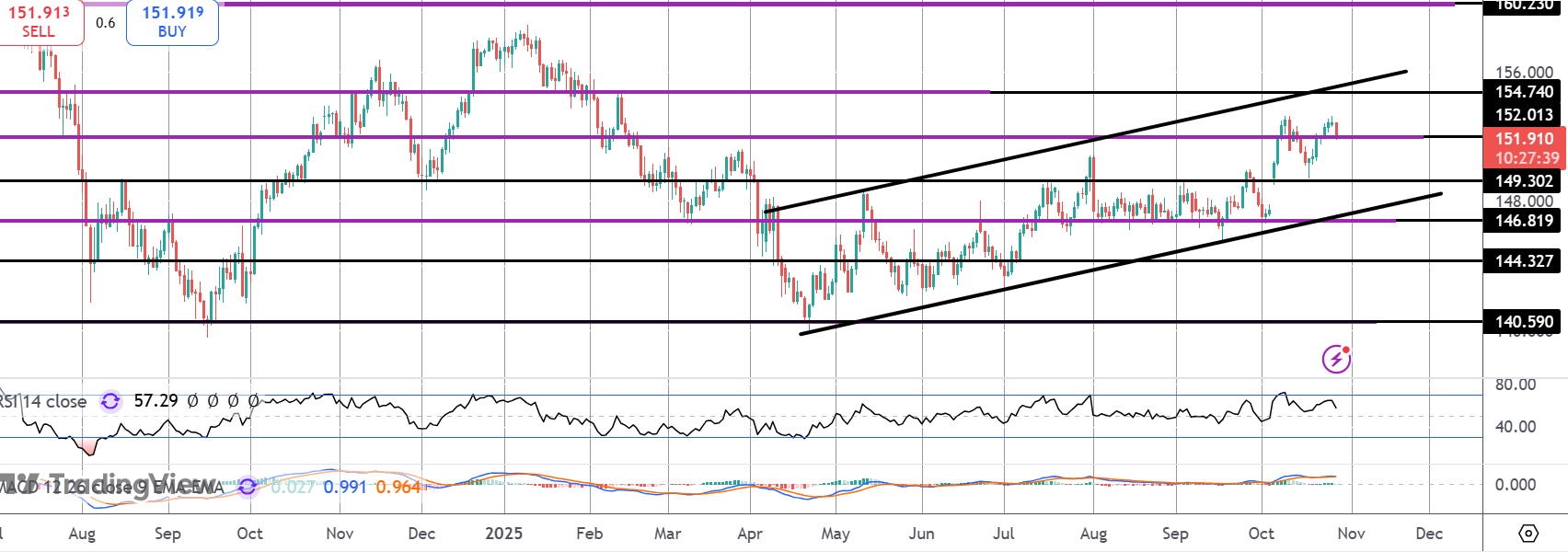

USDJPY

Following a failed retest of the October highs yesterday, USDJPY is now reversing heavily and is testing support at the 152 level. With the potential for a double top here and with momentum studies falling sharply, a break back below this level will turn focus to the 149.30 level next with the bull channel lows coming in beneath that zone. Longer run, the bull bias remains while the channel holds. With 154.74 the next target for bulls.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.