Loonie On Watch Into Fed/BOC Today

Fed & BOC Up Next

The Loonie is on watch today as traders brace for a double central bank bonanza with both the BOC and the Fed to announce their October rate decisions. Both banks are expected to cut rates by a further .25% while signalling additional easing to come, though for now it seems that traders are perhaps pricing in a higher risk of either an unchanged decision from the BOC, or less dovish signalling given the strength we’re seeing in CAD against the Dollar. Indeed, USD has been firmer today across the board making the current USDCAD weakness more interesting.

BOC Expectations

If the BOC does hold off from easing today and we see a fresh rate cut from the Fed, this could drive USDCAD firmly lower through the end of the week. This dynamic could be amplified if a trade deal is agreed between the US and China, resulting in higher oil prices which should offer CAD furtehr support. However, if the BOC cuts rates as expected, we could see a reversal in direction for the Loonie with USD set to rally into tomorrow’s trade deal announcement regardless of Fed easing today.

US/Canada Trade Tensions

Part of the reason for the strength in CAD is the recent uptick in trade tensions between the US and Canada. Trump last week abandoned trade talks with Canada and announced a fresh rise in tariffs over frustration at lack of progress. The tariffs are feeding into higher inflation expectations in Canada as a result and traders will be keen to see how the bank addresses the situation when it meets today.

Technical Views

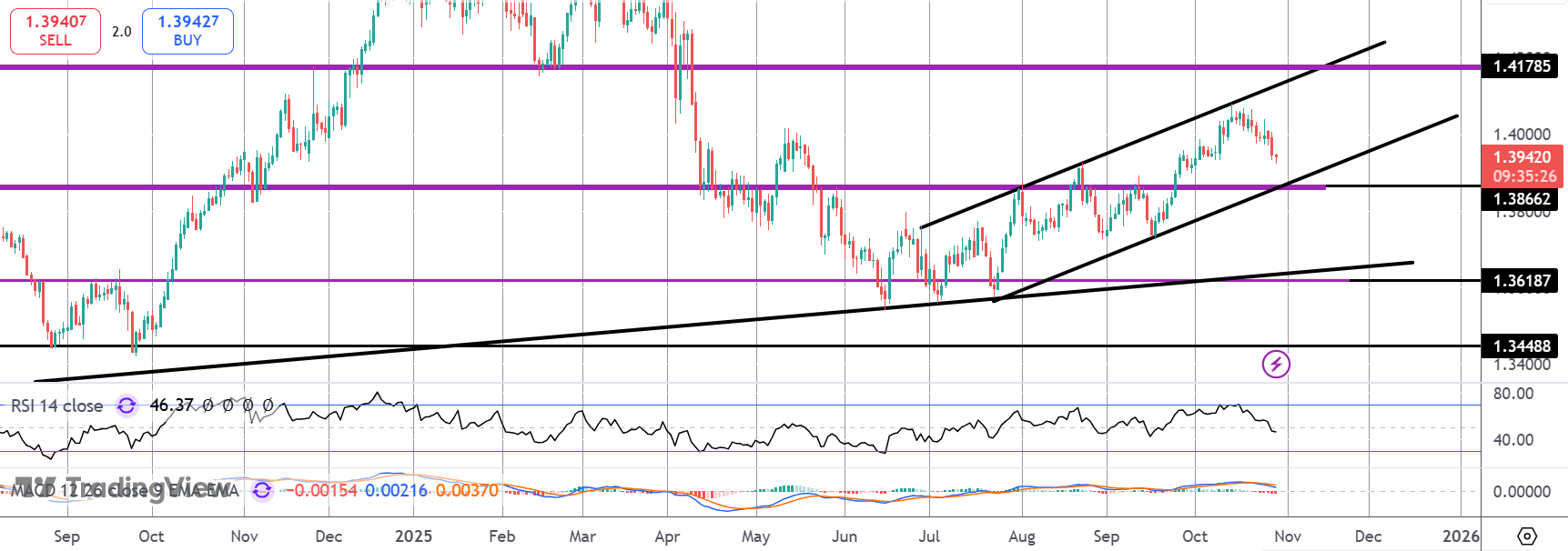

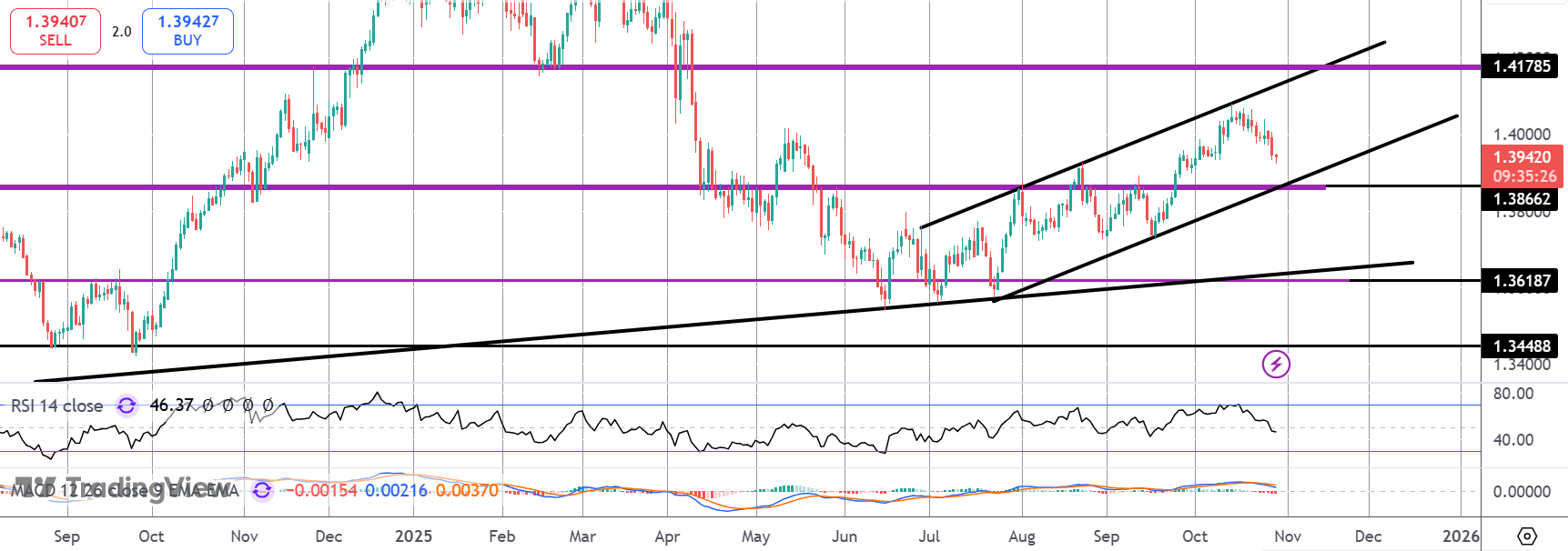

USDCAD

For now, USDCAD is correcting lower within the bull channel that has framed the move off YTD lows. While within the channel and above the 1.3866 level, focus is on a continuation higher with 1.4178 the next resistance to note. If we break below the channel, 1.3618 will be next support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.