Where Next for Bitcoin?

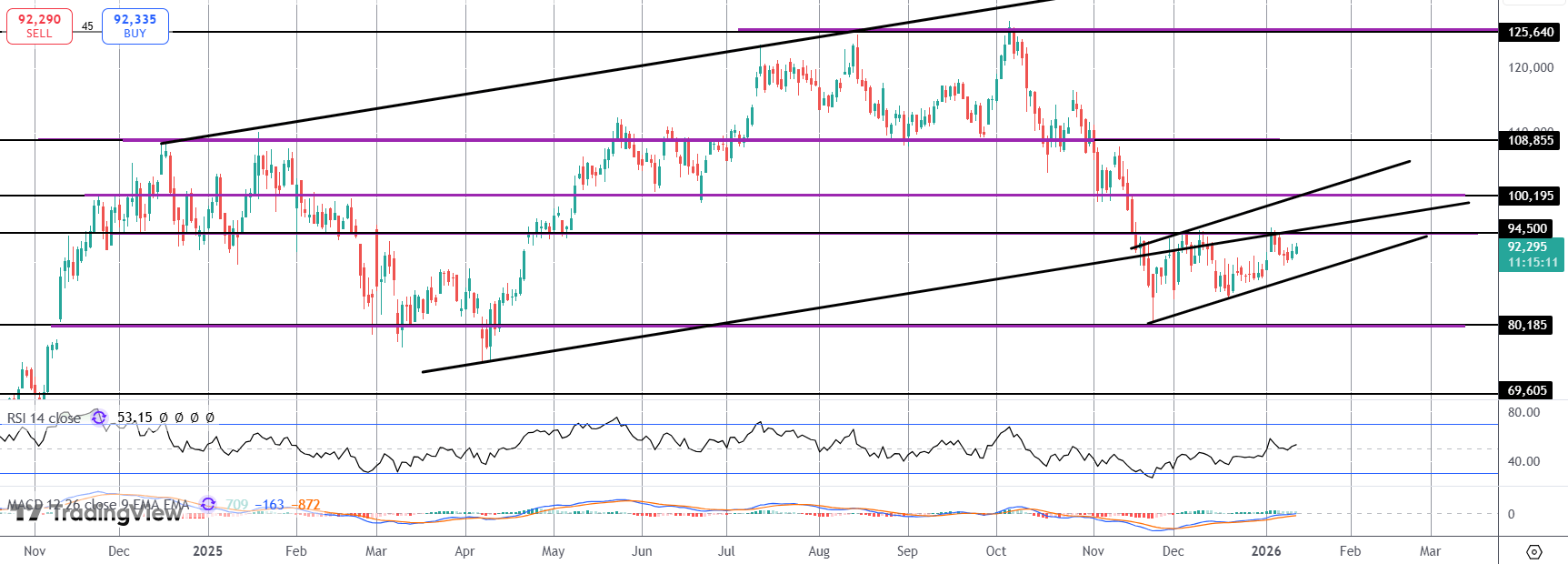

Bitcoin prices remain firmly range-bound for now following the recent failure at the $94,500 level. Price had spiked higher at the start of last week before reversing as USD rose in response to weaker Fed easing expectations but are now pushing higher again this week. Ultimately, the futures market is in a holding pattern here and until we see a break of either the $94,500 level or the $80,185 level lower, there is little to get excited about. Toda’s US CPI data will be a key driver to watch with risks that BTC sells off if we get a USD spike on any hot inflation data. Similarly, we could instead see BTC spiking higher in CPI undershoots forecasts, reviving near-term Fed easing prospects.

Fed Investigation Impact

One very interesting factor to monitor near term is the news that the US government is investigating the Fed over claims of excessive spending on Fed renovations work last year. With the threat of chairman Powell facing indictment, many are claiming the move is simply a sinister attack by Trump on the Fed’s independence over Powell’s refusal to cut rate sin line with Trump’s demands. As such, the integrity of the US system is being called into question with many referring to Bitcoin’s initial philosophical driver of being a way of escaping government and central bank manipulation. If the situation escalates and there is any sense of Powell facing charges, BTC could stand to gain ground firmly as USD comes under pressure amidst a ‘sell-USA’ trade emerging.

Technical Views

BTC

For now, BTC remains within a consolidation pattern at the foot of the Q4 decline we saw. Underpinned by $81,185 and capped by $94,500, the market is still very much in wait and see mode though it does feel like upside pressure is building. If we break higher, the $100k mark will be the big test for bulls near-term, with a break needed to turn focus back to a fresh upside run.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.