Goldman Sachs “Chart of the Day: NFP Preview”, dated 8 Jan 2026)

## GS Base-Case Forecast for December Jobs Report

Goldman’s economists are essentially calling for a near-consensus, “fine not fabulous” payrolls print, with unemployment rounding a bit lower.

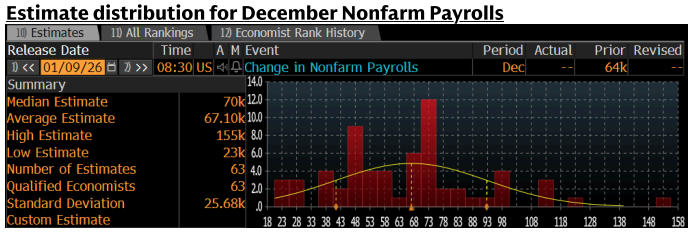

- Nonfarm payrolls (NFP): +70k (Dec)

- GS says this is in line with consensus.

- Unemployment rate: 4.5% (Dec) vs 4.6% (Nov)

- Rationale: November’s unrounded 4.56% was already close to rounding down.

- Also, GS expects some November-specific distortions to fade (notably furloughed federal workers returning).

- Average hourly earnings (AHE): +0.25% m/m (Dec)

- They attribute some restraint to negative calendar effects.

### What they see pushing/pulling the payroll number

A balanced set of offsets:

Supportive

- “Big data” indicators suggest a moderate pace of private job growth.

Headwinds

- Government payrolls: -5k expected, driven by -5k federal, with state/local flat.

- Construction likely slows sequentially after an outsized prior month, plus poor weather early in the survey period.

---

## Event Risk & Market Pricing Mentioned

They flag how modestly the market is pricing the immediate move:

- SPX implied move through Friday close: ~0.75%

(There’s also mention that the day includes NFP and a potential Supreme Court tariff ruling, adding to event risk.)

---

## “Thoughts from around GS” (Cross-Asset Takeaways)

### US Equity Strategy (Ryan Hammond)

Core message: GS expects solid equity gains in 2026, helped by a “goldilocks-ish” mix.

- Baseline: stable labor market, above-consensus growth, below-consensus inflation, and continued Fed easing.

- They think markets haven’t fully priced an early-2026 growth acceleration.

- A solid labor report could boost confidence in re-acceleration → cyclicals outperform.

- Risks/trade-offs:

- Strong data may push bond yields higher, which can cap equity upside (especially lower-quality cyclicals).

- High valuations make equities vulnerable to a very weak labor print.

- Defensive note: Health Care and Consumer Staples look cheap vs history/profitability, but have high short interest.

### Index Vol / Options (Joe Clyne)

Core message: Despite dealer positioning that should dampen moves, they think short-dated event vol looks cheap.

- Street appears long gamma (especially upside) in SPX.

- 1-day straddles pricing implies < ~50 bps move despite dual event risk.

- Preference: own gamma over vega into the event; sees short-dated straddles as underpriced, especially for a negative surprise.

- Where clients are looking: “broadening” trade with interest in RSP and IWM.

- IWM upside viewed as cleaner since it has a similar vol hurdle to SPX but less dealer-gamma “overhang”.

- Hedging idea: short-dated VIX calls/call spreads (Jan/Feb); “vol of vol” seen as still cheap.

### 💱 FX Strategy (Karen Fishman)

Core message: Their base-case (around-consensus jobs + UE rate rounding down) is pro-cyclical.

- Likely market reaction in base case: slightly better growth pricing, some reduction in near-term Fed cut odds, but no hawkish pivot narrative.

- FX implications: pro-cyclical FX outperform (AUD, NZD, SEK, high-beta EM).

- Trade idea highlighted: short CAD/ZAR (with some caution due to a recent sharp move).

- JPY tends to underperform on a positive growth shock (yields + equities up), but USD/JPY upside could raise intervention risk concerns.

- Asymmetry:

- Big upside surprise → cuts priced for the year can be questioned fast.

- Big miss → recession risk reprices from low levels.

- EUR could be among bigger movers in tails (weaker on beat, stronger on miss), though JPY is even more sensitive on a miss.

### Thematics / Baskets (Louis Miller)

Core message: AI productivity may mean less labor intensity over time, changing how payrolls map to equity performance.

- Notes tech’s share of total US employment has fallen since ChatGPT’s public release (~3+ years).

- If AI productivity scales, corporate headcount reductions could drag payrolls in 2026–27.

- Trade preference: long AI Productivity basket (GSXUPROD) into 4Q earnings on the “strong economy / less-strong labor” narrative.

- Also likes a depressed cyclicals basket: slowing labor keeps Fed supportive, but growth supports reflation.

---

## Practical Takeaways

- GS base case: modest NFP (+70k), unemployment rounding down to 4.5%, earnings +0.25% m/m.

- Market setup: SPX implied move ~0.75%; desk thinks short-dated options may be too cheap given event stack.

- If data is solid: helps cyclicals/broadening; pro-cyclical FX bid; watch yields as a limiter.

- If data is weak: negative surprise could move fast if market shifts away from “dealer long strikes”; recession-risk repricing possible.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!