Gold Selling Continues On Trump/China Trade Hopes

Gold Under Pressure

Gold prices have come under fresh selling pressure on Monday amidst a better tone to risk appetite at the start of the week. Talks between US and Chinese officials this weekend went well with the two sides agreeing on a framework for a trade deal ahead of a confirmed meeting between Trump and Xi this week. Optimism that the two leaders can deliver the deal this week, which includes provisions on rare earths access for the US and a fresh tariff suspension, is seeing risk assets rallying this morning, reducing safe safe-haven demand for gold.

Trump & Xi Meeting

Trump and Xi are due to meet on Thursday on the side-lines of the ASEAN summit taking place this week in South Korea. The weekend’s bilateral talks have yielded a strong reason for optimism and gold prices look poised for fresh downside this week accordingly. If talks between Trump and Xi prove positive and the two leaders sign a deal, gold prices should head sharply lower as risk assets and USD rally. News flows ahead of the event should inform gold trading this week and a positive tone from Trump is reinforcing the risk on mood we’re seeing currently.

Bullish Gold Risks

Unless we hear any shock breakdown in sentiment this week, gold price should stay pressure into Thursday’s meeting with heavier downside likely to be seen through the end of the week in response to a deal. However, if the Trump/Xi meeting is cancelled or if the meeting doesn’t result in a deal, gold prices stand to move sharply higher as risk assets recoil, though this is seen as the outside scenario this week.

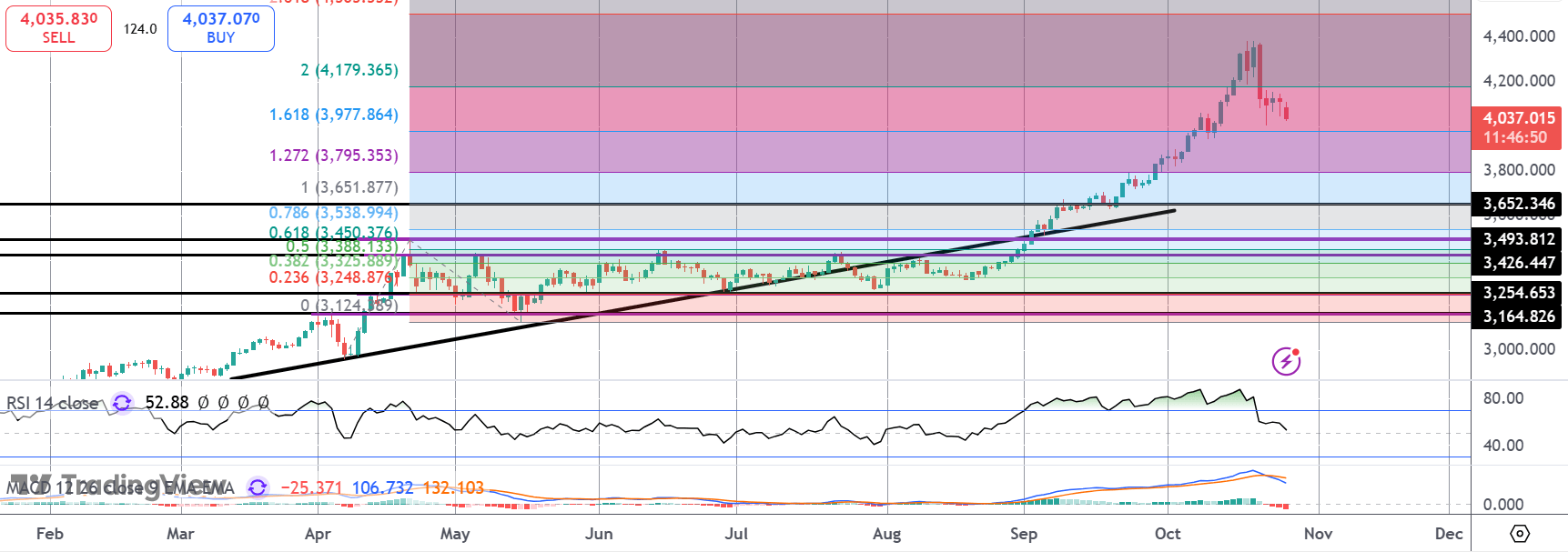

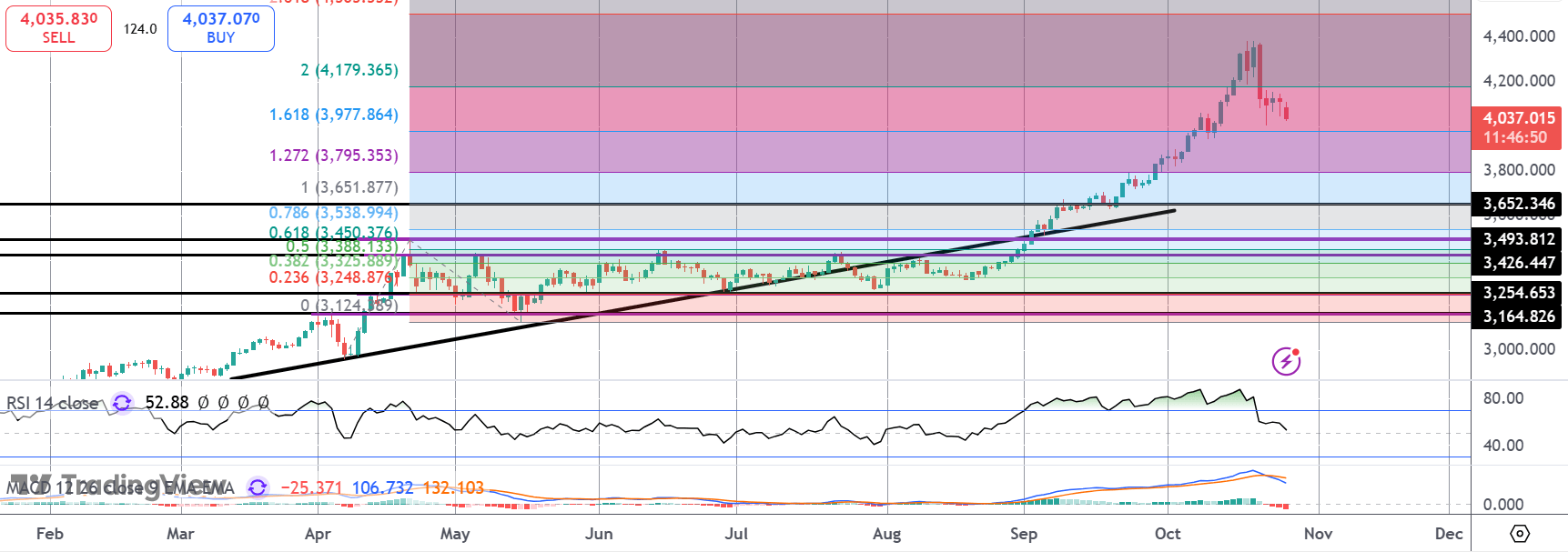

Technical Views

Gold

The market is turning lower again today putting focus on a fresh test of the 3,977.86 level. If we break below there, 3,795.35 will be the next support to note, in line with bearish momentum studies readings. Topside, bulls need to get back above 4,200 to regain momentum.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.