Why should the Fed prefer higher oil prices?

Heated by uncertainty in the Strait of Hormuz and the Gulf of Oman, due to attacks on tankers and the downing of American drone by Iran, oil prices have been particularly unstable recently. On Thursday, WTI posted spectacular intraday gain of 6%, rising to $57 per barrel. However, the rise of prices associated with all these events is not enough to plug a hole in the "bottomless pit" of investments plowed in the shale industry, which continues to "rob" investors because of thin margins:

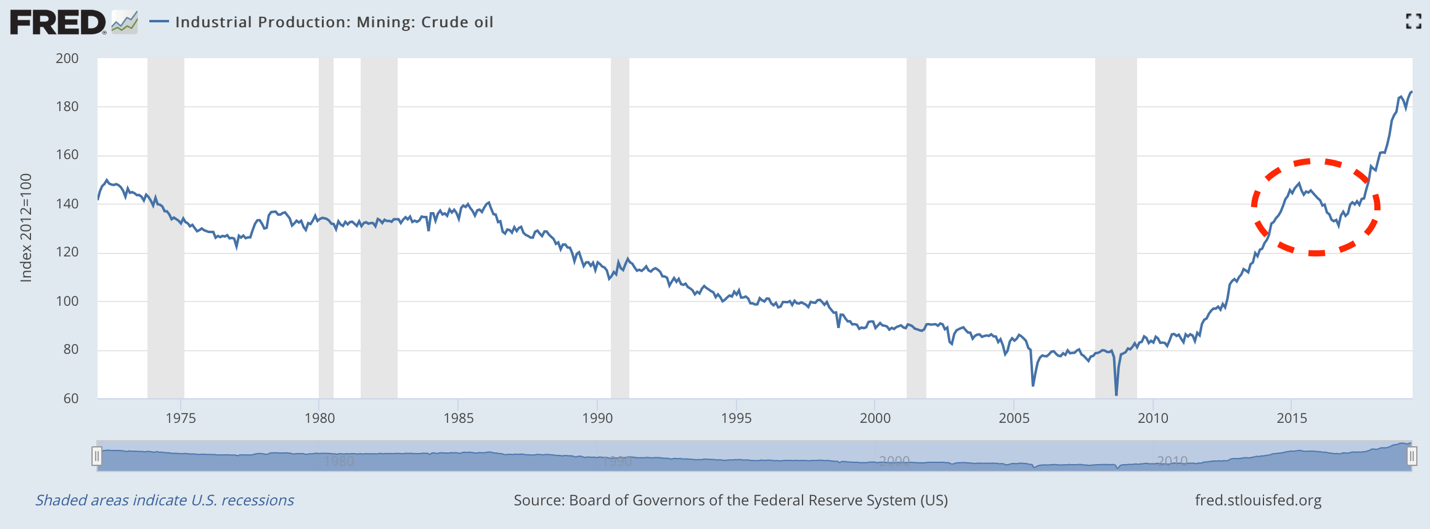

Two episodes of a fall in the price of WTI below $50 are associated with a sharp increase in US oil production. At the same time, during the price collapse in 2014-2016, when the WTI barrel lost 75% of its value in 18 months, it was accompanied by an increase in the number of bankruptcies of oil and gas companies in the United States, whose initial strategy was to increase production through debt financing.

The production boom was supposed to come to naught in 2016, when mining turned into a decline, but Wall Street investments made it possible to survive the crisis and renew the advance on OPEC and Russia:

A further increase in production led to an interesting situation: net exports rose from deep negative level to almost 0, making the economic effect of low fuel prices controversial. Let me explain why.

From the standard macroeconomic point of view, reduction in consumer spending on fuel should free up money for discretionary purchases that directly stimulate retail sales, and to a small extent, durable goods orders. And since the component of consumption in GDP is about 70%, and its shocks are a source of economic crises in most cases, the Fed and the government considered the priority to boost consumer spending. In addition, in a situation where the bulk of energy needs were covered by imports, the rise in oil prices basically meant that US consumers "paid for the welfare" of oil-exporting countries. A sharp increase in prices could create that notorious shock of consumption, which could be followed by a recession.

Now, when US oil and gas firms continue to vigorously “burn” invested dollars, these funds, however, are spent in the USA — on high wages, infrastructure, capital investments, storage facilities, engineering services, etc., that is, this type of spending has favorable domestic multiplicative effect. It is worth adding here that a developed domestic energy sector is stable during a slowdown in the economy and a recession, since the consumer cannot drastically cut fuel expenditures. But import of retail goods can be reduced significantly if the consumer starts to save more.

The fact that the US economy misses the opportunity to feel this effect, were mentioned at the last meeting by Fed Chairman Powell. He mentioned that “lower oil prices” are a dark spot in the picture of capital investment and manufacturing production. They not only restrain investment in production, but also force companies to generate weak demand for new equipment (which, by the way, is also produced in the USA).

This was noticeable during the collapse of prices in 2014-2016, when the sector significantly reduced investment. The US economy began to slow down in 2015 and 2016, GDP slowed to 1.6%, the lowest rate since the Great Depression. However, then followed by the revival of shale production and economic growth accelerated.

When the US was an importer of both retail goods and oil, it was obvious that it was more profitable for the economy to ensure greater “freedom of consumption” by reducing the expenses on essential goods, including fuel. That is, low oil prices were needed. With the advent of energy independence, boosting expenses of retail goods will mean funding the countries producing these goods and putting pressure on their own energy sector. Simple protectionism.

The other side of the coin: rising fuel prices hit consumer optimism and at the wrong moment (during slowdown) can put consumers in a savings mode. That is, shifts will not occur within consumer spending (which does not change the sum), but shifts between consumption and savings, which is not acceptable under the conditions of the model of infinite expansion.

It is curious how the Fed will shape policy in the new realities where the US is the largest oil producer in the world.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.